The following analysis by AppGrowing is based on advertising data from 50 countries/regions and 28 global media platforms. It examines the characteristics of overseas mobile app advertising in July 2024.

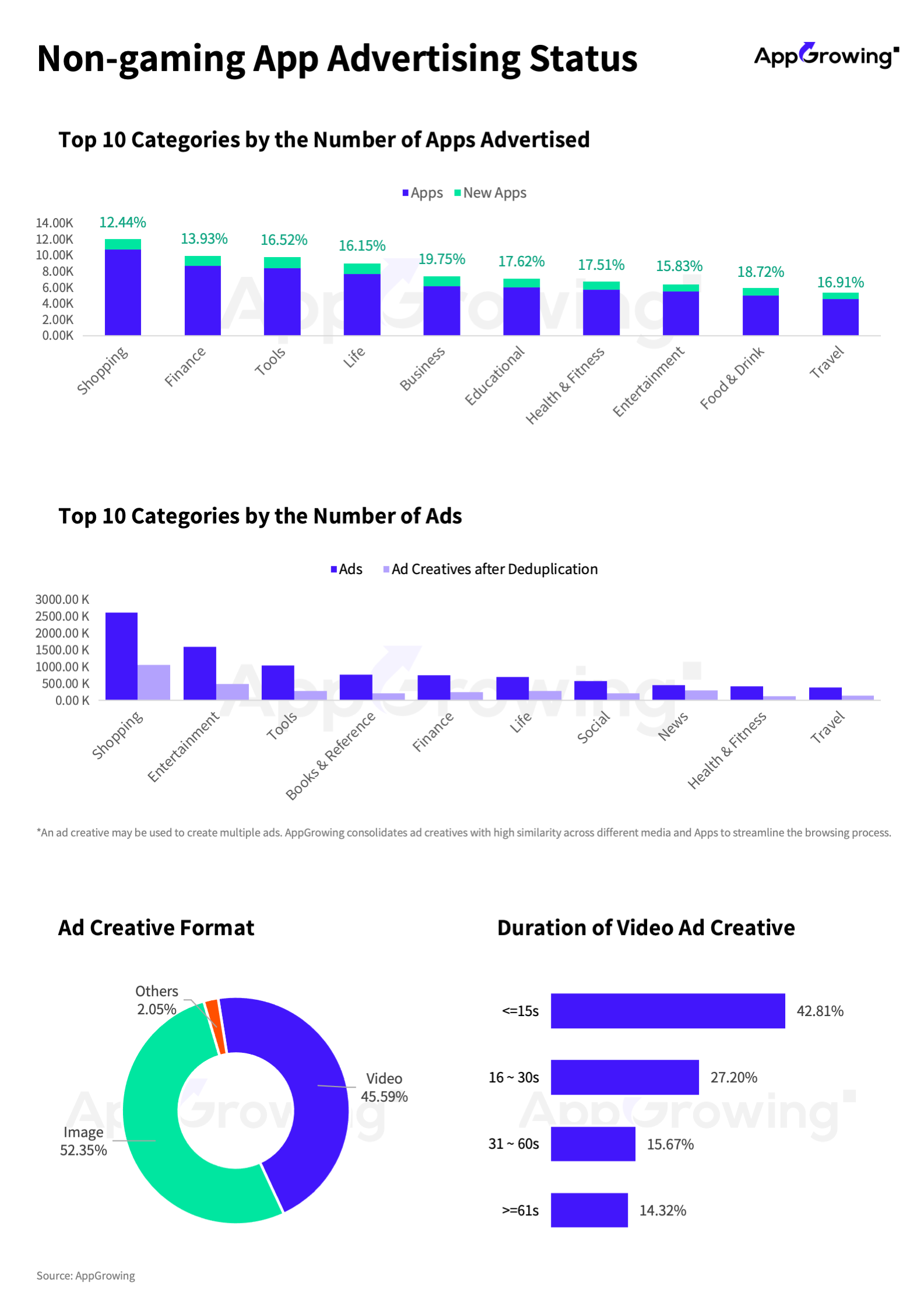

In July 2024, the top three app categories with the highest percentage of advertising overseas were Shopping, Finance, and Tools. The top three new app categories were Business, Food & Drink, and Education.

Compared to June, the overall percentage of new apps being advertised in each category has declined, indicating that market competition is stabilizing in the short term and developers are acting more cautiously.

Regarding ad volume, the Shopping category continued to lead significantly, with over 2.5 million ads and more than 1 million unique creative materials, maintaining the highest share. Entertainment ranked second, followed by Tools.

In terms of material types and video duration distribution, app advertisers tend to prefer image materials and videos shorter than 15 seconds. This month, image materials accounted for over 50% of the ads, while videos shorter than 15 seconds made up 42.81%.

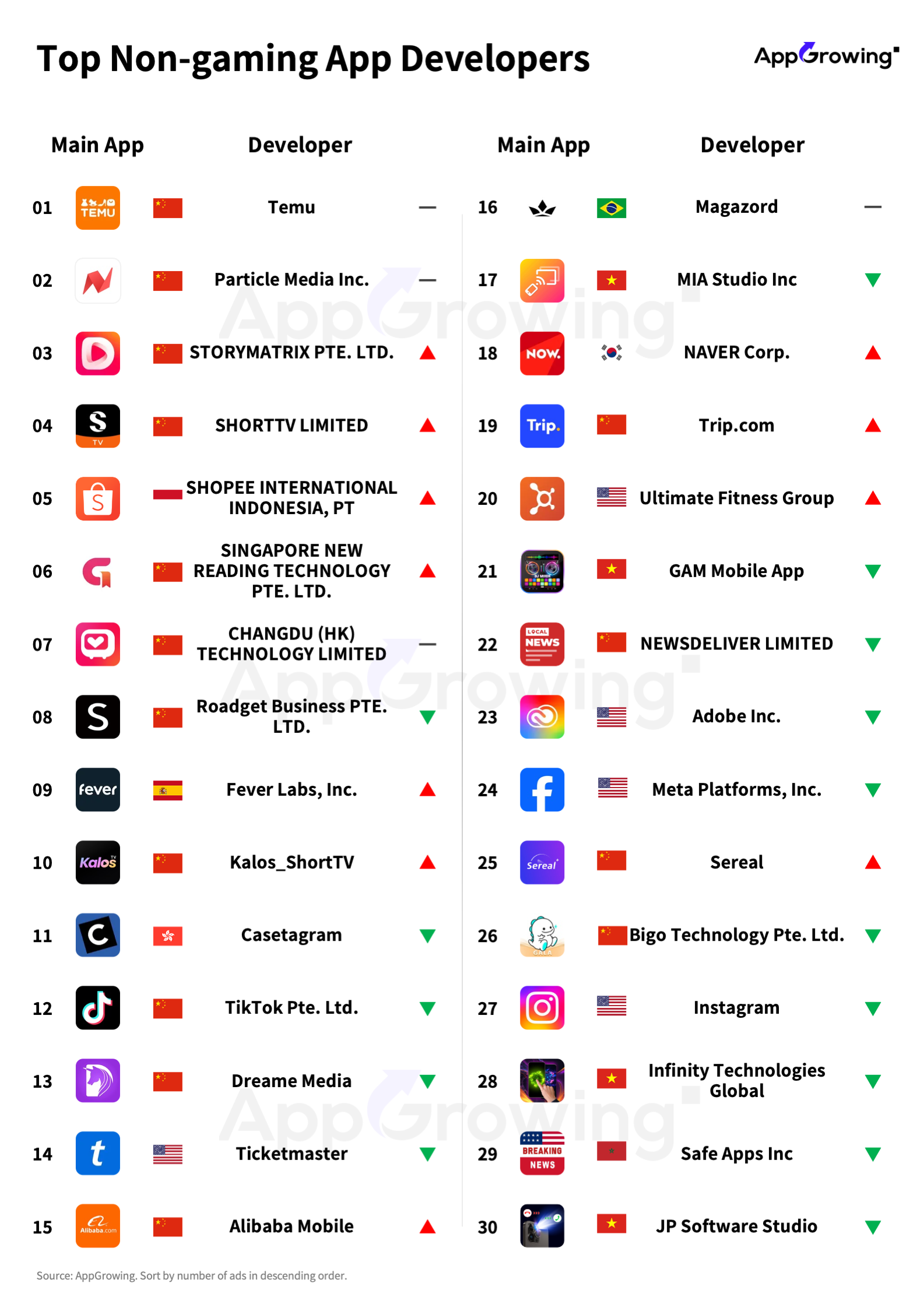

According to AppGrowing, the top 30 overseas app advertisers in July were led by TEMU , Particle Media, and STORYMATRIX PTE. LTD. . TikTok, which ranked third in June, dropped to twelfth place on the list this period.

This time, 15 Chinese companies made it to the list, capturing half of the spots, with Shopping and Entertainment products being their primary focus.

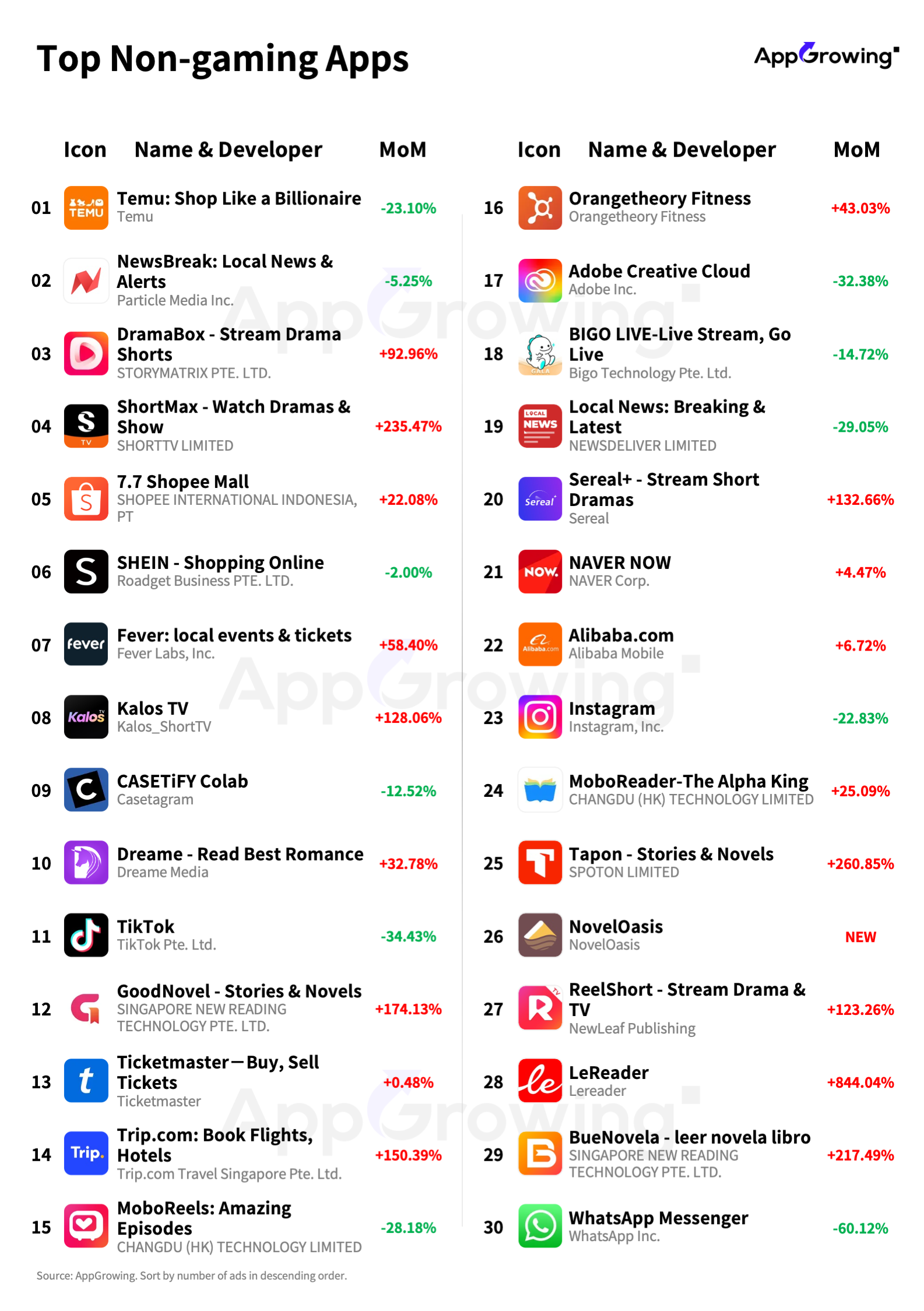

Looking at the top 30 product advertisers, the listed products generally showed a trend of increasing ad volume month-over-month. In July, leading overseas apps maintained a proactive approach to advertising.

However, both TEMU and NewsBreak, which ranked first and second respectively, experienced a decrease in ad volume, with declines of 23.10% and 5.52%. NewsBreak has seen a month-over-month decline in ad volume for two consecutive months.

DramaBox, which ranked third, saw a 92.96% increase in ad volume compared to the previous month, moving up from seventh place last month.

There is a new entry on this month's list from Chinese developer Kuaiwan Technology, NovelOasis, which ranks 26th and is a novel reading app.

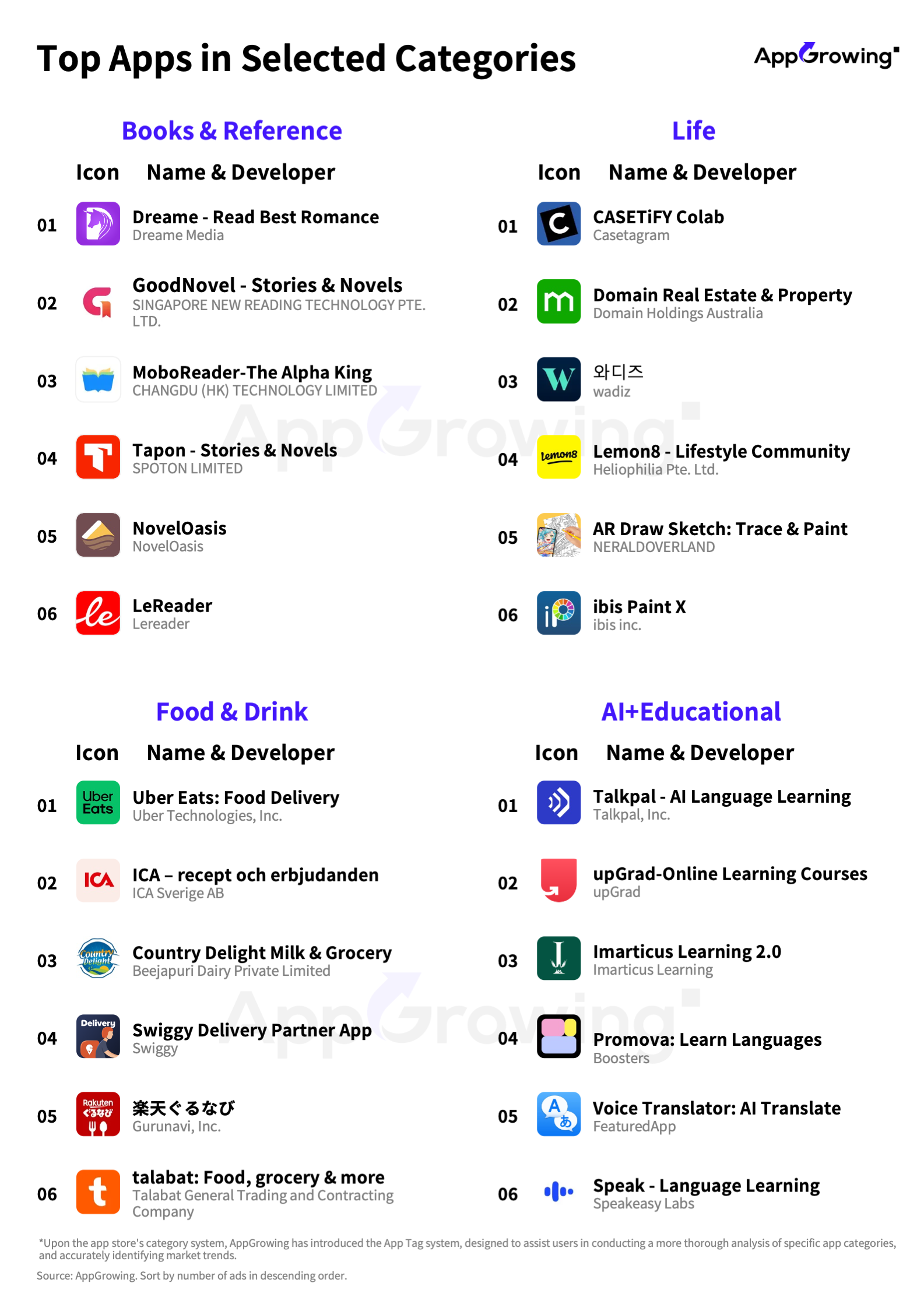

For this period, AppGrowing selected four categories: Books & Reference, Lifestyle, Food & Drink, and AI+Education.

In the app advertising list for this period, the six products recorded saw month-over-month growth in ad volume. LeReader saw an increase of 884.04%, highlighting the high level of activity in this category in overseas markets recently.

In the Lifestyle category, the top spot goes to CASETiFY Colab from Casetagram, which specializes in custom protective cases and accessories for electronic devices.

In the Food & Drink category, Uber Eats leads as a food delivery service app. The AI+Education category is dominated by language-learning apps, with Talkpal, a GPT-based language-learning app, taking the top position.

In this month's app advertising list, there is a noticeable increase in the number of Books & Reference apps. In addition to regulars like Dreame, GoodNovel, and MoboReader, four new apps have been added: Tapon, NovelOasis, LeReader, and BueNovela.

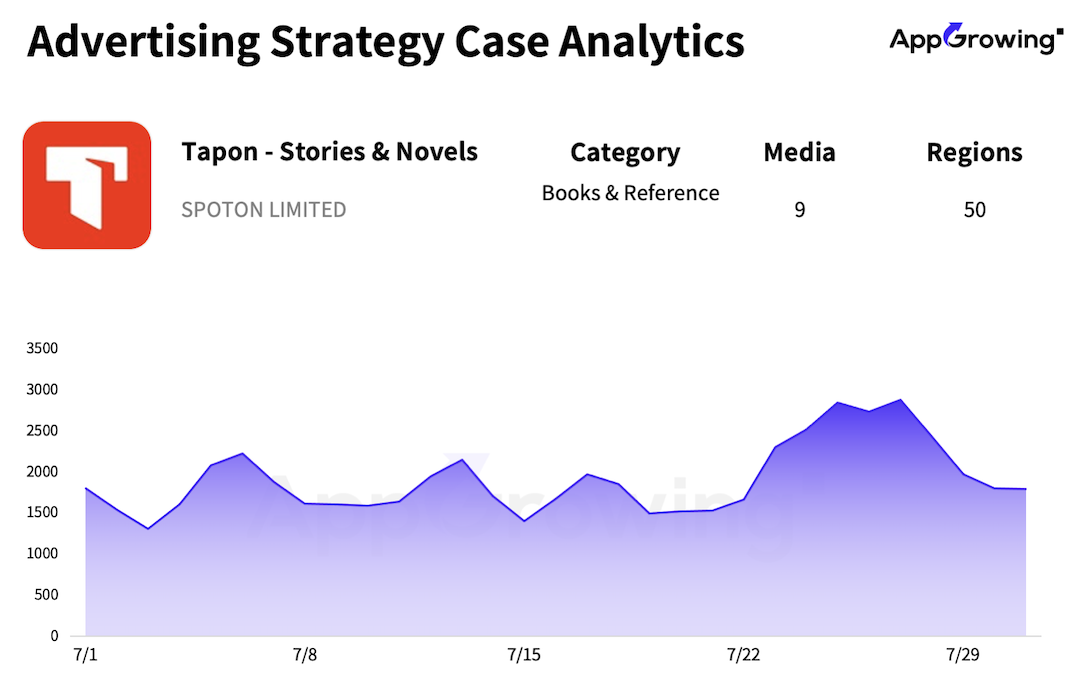

Tapon is a novel reading app. According to AppGrowing , the app significantly increased its advertising in July, with a 260.85% month-over-month growth in ad volume.

Tapon has invested in AI-generated image materials, emphasizing "free reading" as a key selling point. In terms of videos, simple formats with background images and subtitles have also gained good exposure.

These materials often highlight key phrases in the subtitles, such as "millionaire," which directly appeal to human desires and immediately capture user attention.

Another category, the formula of “underdog to hero” stories continues to have a massive audience today. In this ad, the first three seconds show a woman getting slapped by her husband and being choked, maximizing the conflict to capture viewers‘ attention. Then, the scene shifts to the woman signing a divorce agreement and removing her ring. In the next scene, she is now a millionaire riding in a luxury car. The story's fast-paced narrative allows it to quickly deliver satisfying plot points, effectively reaching the target audience.