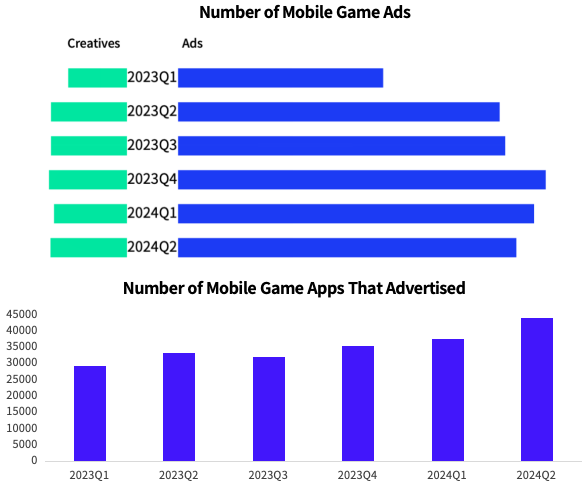

In H1 2024, the global mobile game advertising market continued to show signs of recovery. Over 6,000 new mobile games launched advertising campaigns in the second quarter, marking a significant increase from the first quarter.

However, if we look back at the data from 2023, it is evident that since Q4 2023, there has been a steady decline in ad volume in the global mobile gaming market.

Game developers are adopting a more cautious approach to user acquisition through advertising, reflecting the increasing competition in the international mobile game advertising arena.

Despite this, as advertising has become a standard method for acquiring users, game companies still place significant emphasis on marketing.

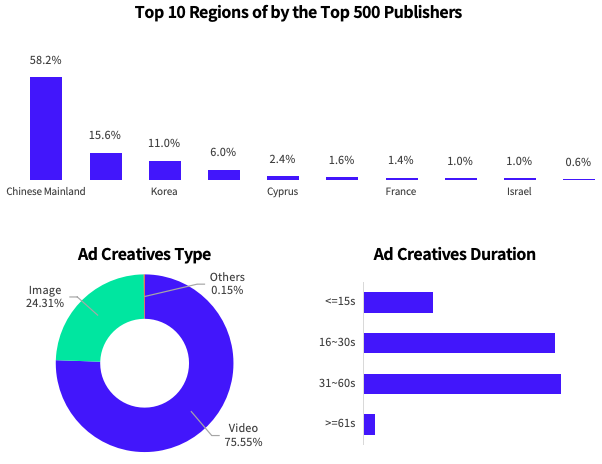

Meanwhile, Chinese developers remain actively engaged in overseas markets, achieving a leading position in advertising across several major categories. This suggests that international expansion is still seen as a key growth opportunity by Chinese developers.

Looking back at the first half of 2024, what new trends have emerged in the global gaming market? What new category opportunities are available? AppGrowing has officially released the "Global Mobile Game Advertising Market Insights (2024 H1)" which comprehensively analyzes trends in the first half of the year, helping industry players identify new opportunities.

From this report, we observe the following three market evolution trends:

- The popularity of "Mini-Game" in the international market continues to rise, with several leading companies joining the trend. There is a noticeable shift toward lighter designs in mid/hard-core categories.

- Mini-games remain a key solution for driving traffic in mid/hard-core genres. However, the pace of iteration for this strategy is accelerating, demanding timely responsiveness from marketing teams. Additionally, there is a trend towards integrating diverse gameplay elements into these mini-games.

- The influence of trending short videos and viral content on advertising creativity is deepening, especially in East Asian markets like Japan, South Korea, Greater China, and Southeast Asia. Platforms like TikTok, with their substantial young audiences, offer new avenues for user acquisition through game advertising.

The following is an excerpt from the report. For the full content, please refer to the "Mobile Game Advertising Creative and Strategy White Paper (2024 Q1)" PDF.

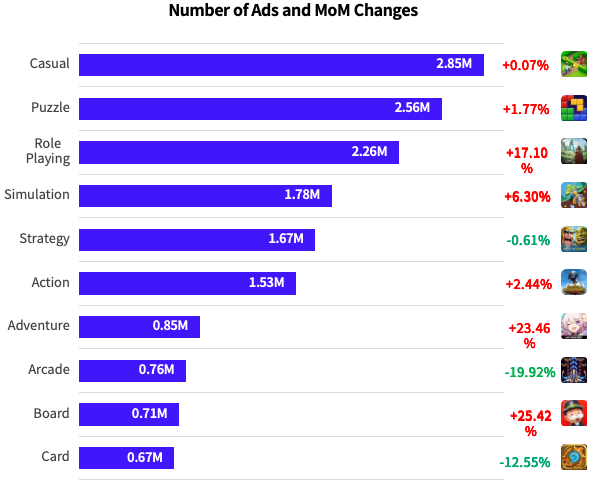

Gaming Advertising Growth Trends

In the first half of 2024, casual and puzzle games remained the primary categories for ad spend in the global mobile gaming market, maintaining stable growth. However, other light/mid-core genres, such as arcade and card games, experienced a noticeable decline in ad volume.

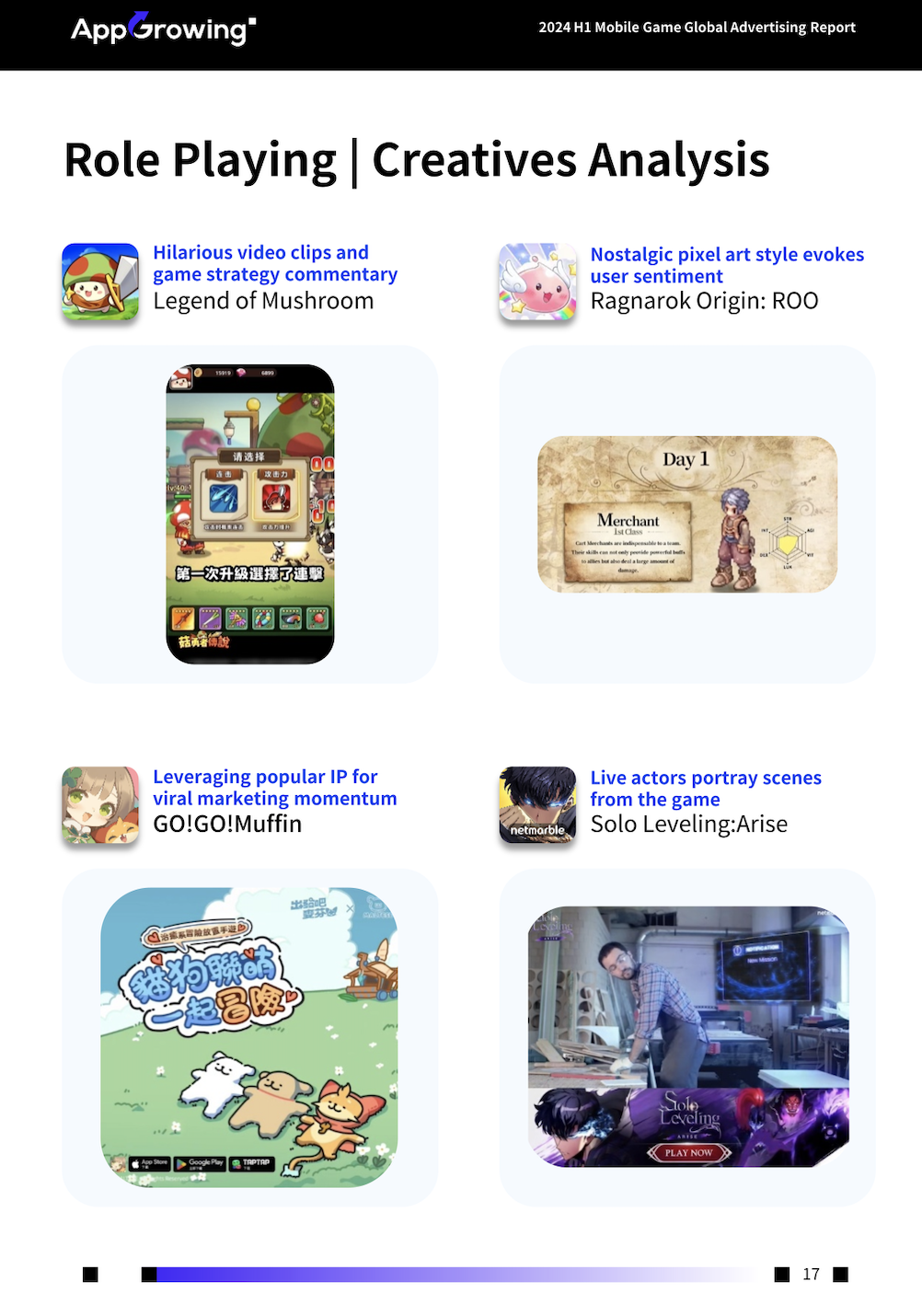

Among mid/hard-core games, RPGs continued to be the most actively advertised genre, with over 17% growth quarter-on-quarter, second only to the adventure category.

This growth was driven by lighter game releases, such as "Legend of Mushroom," which transitioned from mini-games to apps, and "GO!GO! Muffin," a social light MMO. These new releases contributed to market growth, reflected in advertising efforts.

Insights into Game Categories Advertising

RPGs are a major category in the global mobile gaming market, consistently showing high value and market potential. However, RPG preferences are distinctly regional. According to AppGrowing, popular RPGs in different markets have noticeably varied styles.

In Western markets, influenced by console/PC games, users tend to prefer dark and adventure themes, as seen in NuverseGames' CRPG mobile game "Dragonheir: Silent Gods." In Japan, the standout title is 4399's "Legend of Mushroom," which has undergone significant localization and uses generous incentives and brand marketing to capture Japanese users.

In Korea, the new game "Solo Leveling: Arise" has performed well, leveraging a popular local IP to gain traction. Meanwhile, users in Taiwan and Hong Kong prioritize social features, with XD's "GO!GO! Muffin" using a "social + MMO" approach to capture the market.

Mobile Game Publisher Marketing Case Study

XD's standout game this year is "GO!GO! Muffin." This product, which focuses on "social + idle MMO" gameplay, has achieved impressive results in both domestic and international markets.

According to AppGrowing's "Ad Campaign Phase Comparison" feature, "GO!GO! Muffin" began its pre-registration at the end of December 2023 and had a small-scale ad campaign in mid-January. Instead of extensive pre-registration marketing, the budget was allocated for a major push post-launch, and ad spending was reduced as the game reached a stable operational phase, maintaining steady exposure.

Regarding channel distribution, during the pre-registration phase, "GO!GO! Muffin" primarily allocated its ad budget to TikTok, likely aiming to reach a broader young audience through TikTok's popular short video social media features. Post-launch, the budget shifted back to mainstream media platforms like Meta and Google, indicating a focus on multi-channel user acquisition and building brand presence.

From the advertising strategies of leading companies and hit new games, it's evident that the rapidly evolving global gaming market is having a profound impact on marketing strategies. Enhancing data-driven decision-making, localization adaptation, and creative capturing abilities is crucial for game marketing, development, and distribution.

For more insights into market trends, overseas marketing strategies, and publisher analyses, refer to the full "Global Mobile Game Advertising Market Insights (2024 H1)" report.