According to AppGrowing, the Advertising Volume and App Volume of the Global Mobile Game Market declined in August. In terms of the proportion of the two, Chinese developers remained steadily heavy advertising, occupying 4 seats among the Top 10 Developers.

Here is AppGrowing's analysis of the global mobile game advertising markets in August 2023, based on advertising data from 25 global media platforms in 50 countries/regions.

01 Advertising Trend

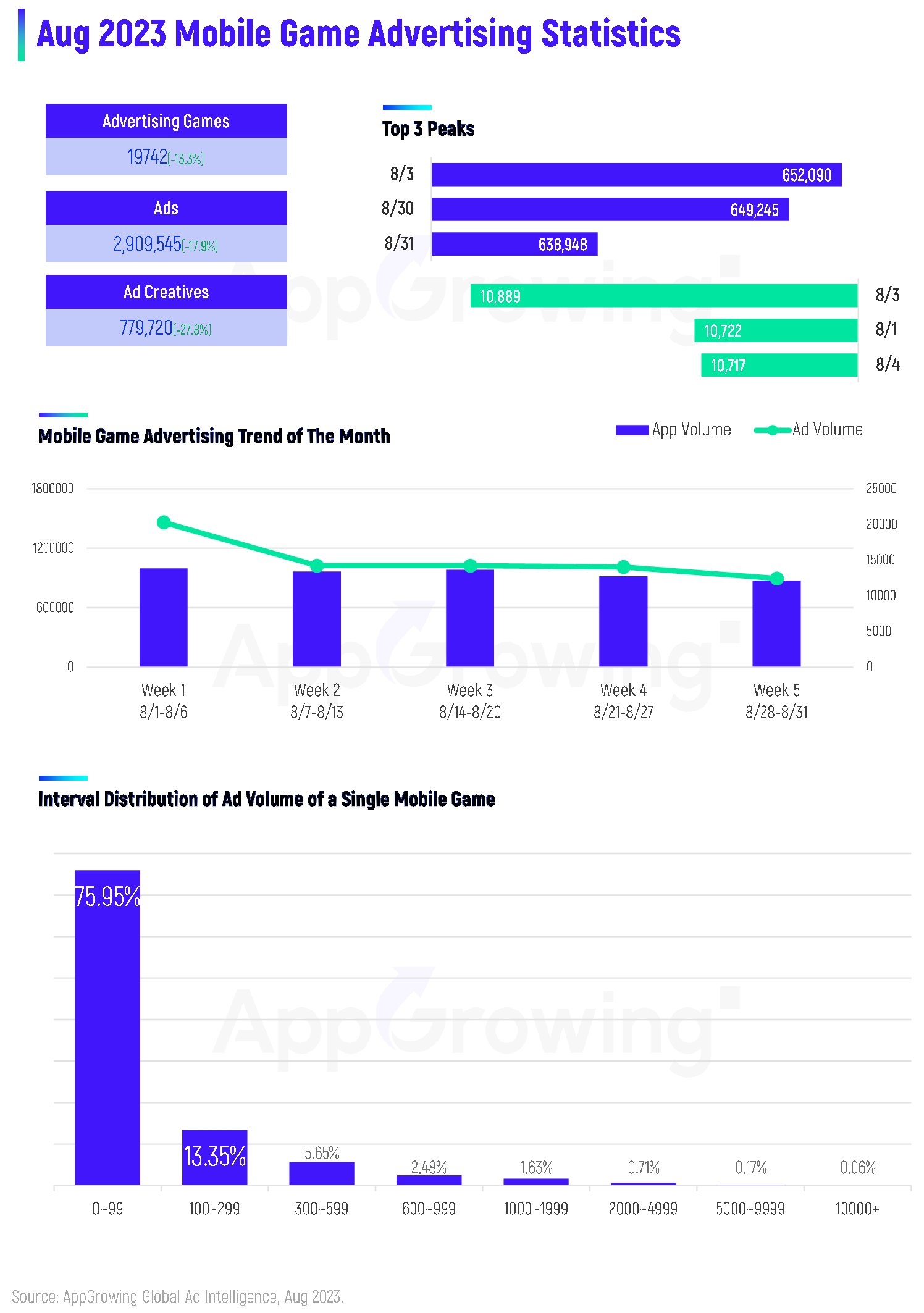

In August 2023 the App Volume was 19742, down 13.3% MoM. The Ad Volume was 2.9M+ and Creative Volume was 770K+, down 27.8% from July.

From a single day perspective, the peaks of Ad Volume and App Volume appeared in Week 1, with August 3rd being the highest of the two, at 650K+ and 10889, respectively. The App Volume for the whole month varied smoothly, though the weekly number was below 15K. Regarding the Ad Volume, it is over 600K every week, with Week 1 being the peak, over 1.2M.

In terms of the distribution of ad volume, 75.95% of mobile games were in the 0-99 range, slightly higher than the proportion in July. 13.35% of mobile games were in the 100-299 range, and 5.65% were in the 300-599 range.

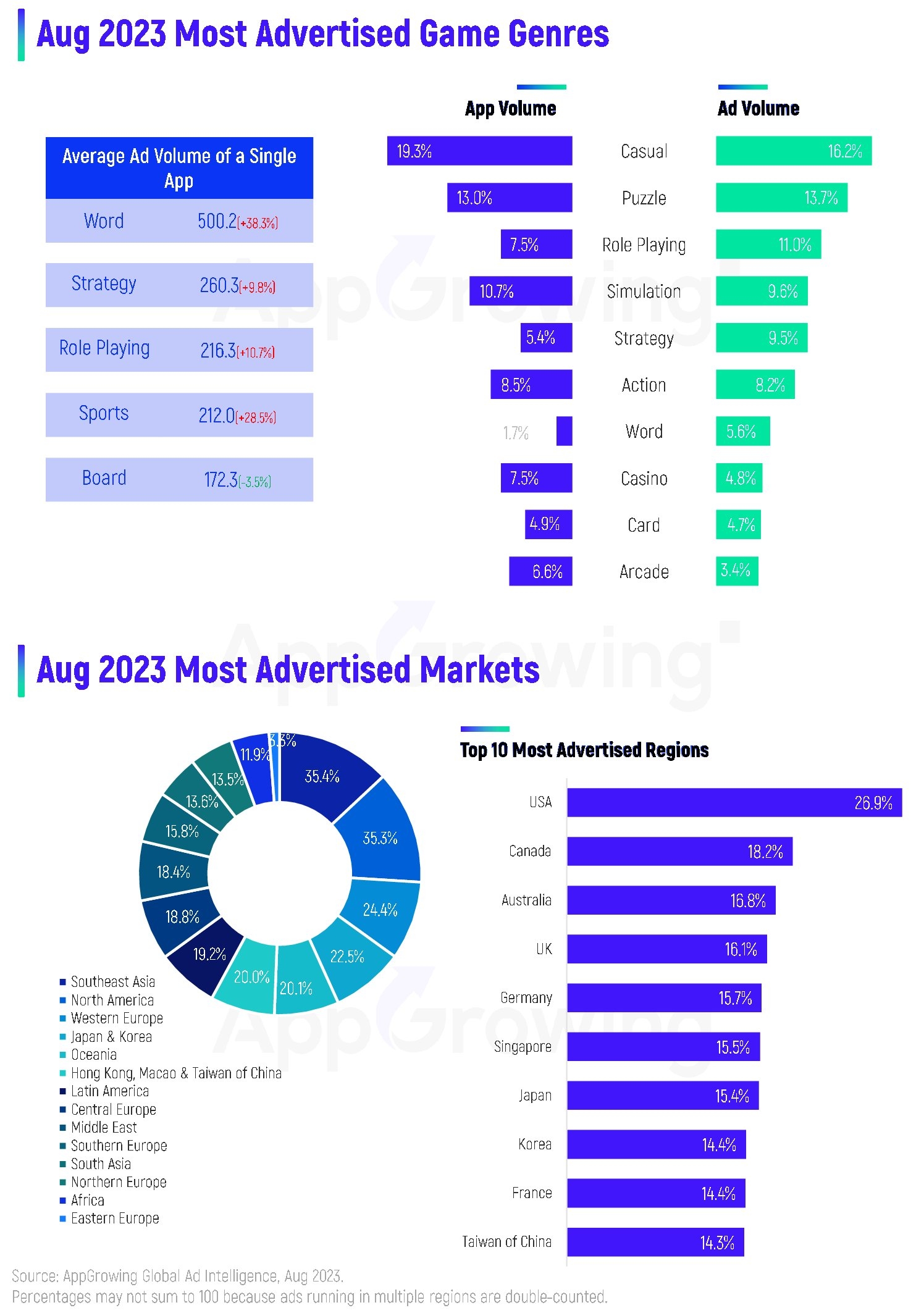

In terms of genres, the Casual remained No.1 in terms of Apps and Ads, with 19.3% and 16.2% respectively, though with a slight drop compared to July. Puzzle continued to be the No.2, with 13% of App Volume and 13.7% of Ad Volume.

The Top 5 in Average Single App Ad Volume are Word, Strategy, Role Playing, Sports, and Board. Except Board, each of the rest experienced MoM growth on varying degrees.

Looking at key markets, the Top 3 regions were the same as in July. Southeast Asia took the No.1 at 35.4% of total ad volume, up 2.3% MoM. North America and Western Europe followed with 35.3% and 24.4% respectively. In addition, Japan and Korea, Oceania, and Hong Kong, Macao and Taiwan of China accounted for more than 20%.

Specifically, the share of the USA soared to 26.7%, while the TOP2-5 were Canada, Australia, the UK, and Germany, reflecting game developers‘ continuing investment in the European and American markets.

02 Most Advertised Games

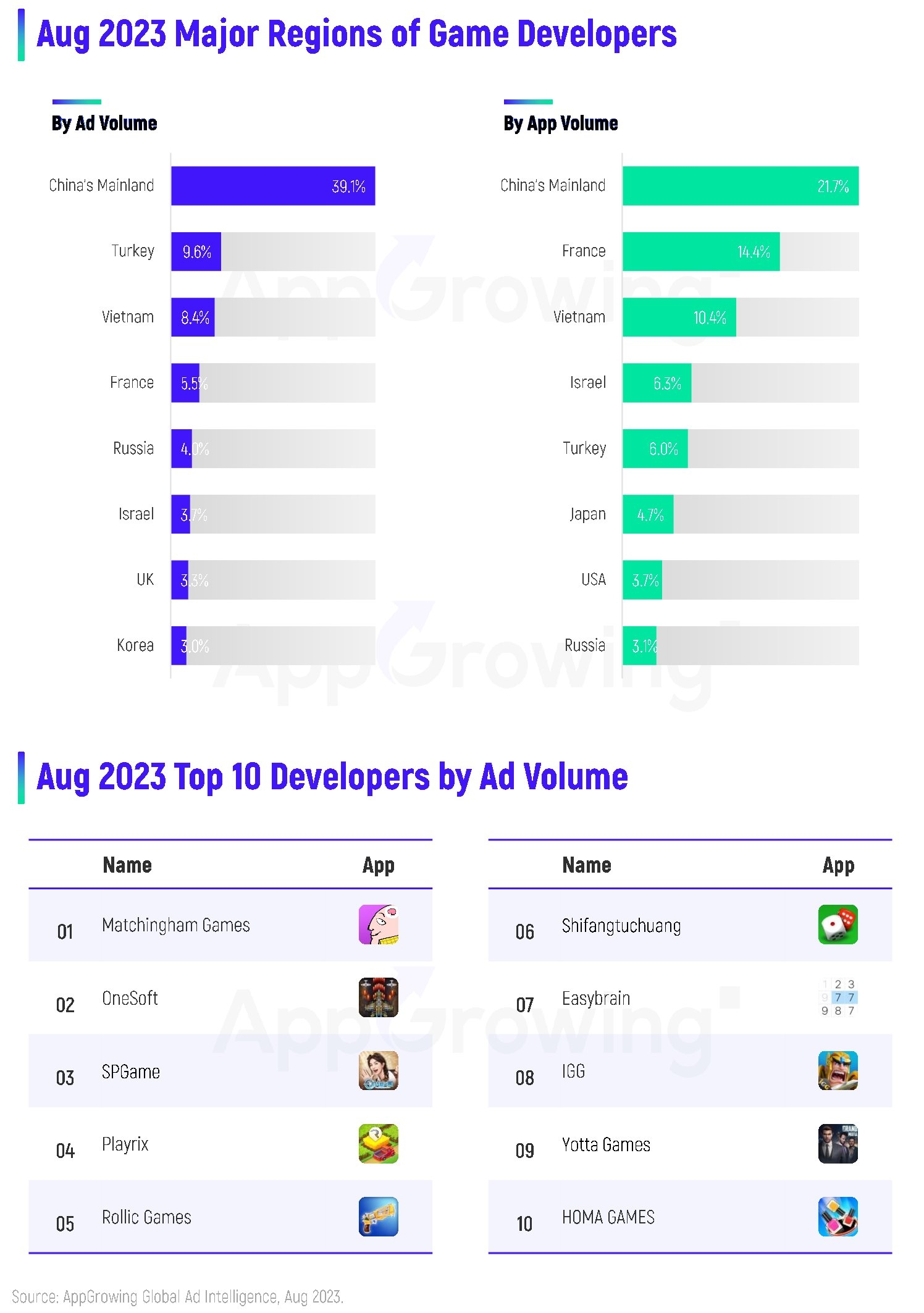

Among the sources of handheld game developers in August, China’s mainland kept on leading the way, with the ad volume proportion rising to 39.1%. Its App volume proportion was 21.7%, also slightly higher than that of July.

Turkish developers ranked No. 2 in Ad Volume share with 9.4%, while Vietnamese came in No. 3 with 8.4%. French developers remain in No.2 with 14.4% of the App Volume.

As for the Top10 developers, Matchingham Games returns to No.1, followed by OneSoft and SPGame at No.2 and No.3. 4 Chinese developers made the list this month, namely SPGame, Shifangtuchuang, IGG and Yotta Games. Except for the 2nd one, the other 3 are starring in midcore and hardcore games.

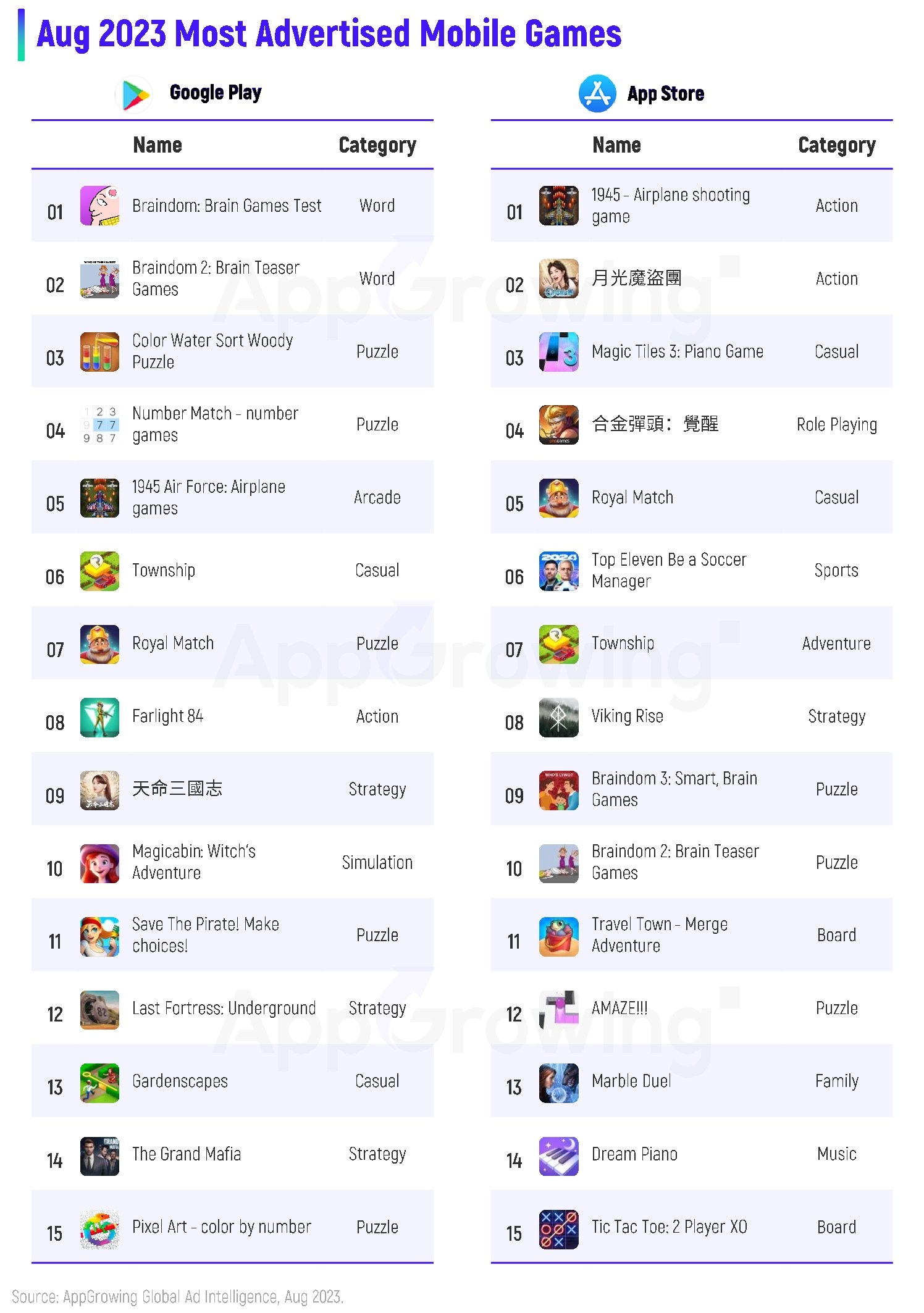

For most advertised mobile games in August, the Top 5 on Google Play came from the Word, Puzzle, and Arcade, and Puzzle was still the category with the most entries. Braindom: Brain Games Test remains at the Top1.

There are five mobile games from China in the Top 10, namely Lilith Games' Farlight 84, 《天命三國志 (Destiny of the Three Kingdoms)》, IVYMOBILE's Magicabin: Witch's Adventure, IM30's Last Fortress: Underground, and Yotta Games' The Grand Mafia.

2 mobile games from Vietnam are in the Top 5. Matchingham Games and Playrix both still got 2 games in the Top 10.

On the App Store, 1945 - Airplane Shooting Games by OneSoft is still No.1, while SPGame's new RPG 《月光魔盜團 (Moonlight Pirates)》 is at No.2. Metal Slug: Awakening, developed by Tencent from China and published by VNG from Vietnam, came in at No. 4. AppGrowing has made in-depth analysis with the games' success and advertising strategy.

For the Top pre-registrations in August, Sea of Dawn ranked No. 1 on App Store. Its target markets are Hong Kong, Macao and Taiwan of China, which is the same as half of the games on the list. Advertising and branding during pre-registration is highly valued in marketing localization in the region.

On Google Play, 《鬥破蒼穹:怒火雲嵐 (Battle Through the Heaven: Raging Cloud Arash)》 ranked No. 1, and NUVERSE's Dragonheir: Silent Gods is No. 7. The otherworld theme mobile game Isekai: Slow Life, which has entered the USA's Top 100 Grossing Mobile Games in the first 2 weeks of its launch, is currently pre-registerd in Latin America and Europe. In addition, there are 2 Word games on the list.

03 Mobile Game Advertising Case Analysis

Case1: 《月光魔盜團 (Moonlight Pirates)》

According to AppGrowing, SPGame's new RPG Moonlight Pirates kicked off pre-registration on August 10th in Taiwan and Macao, and then in Hong Kong, Malaysia, and Singapore on August 19th. The game is now officially launched and remains the Top1 Gossing iOS game in Taiwan.

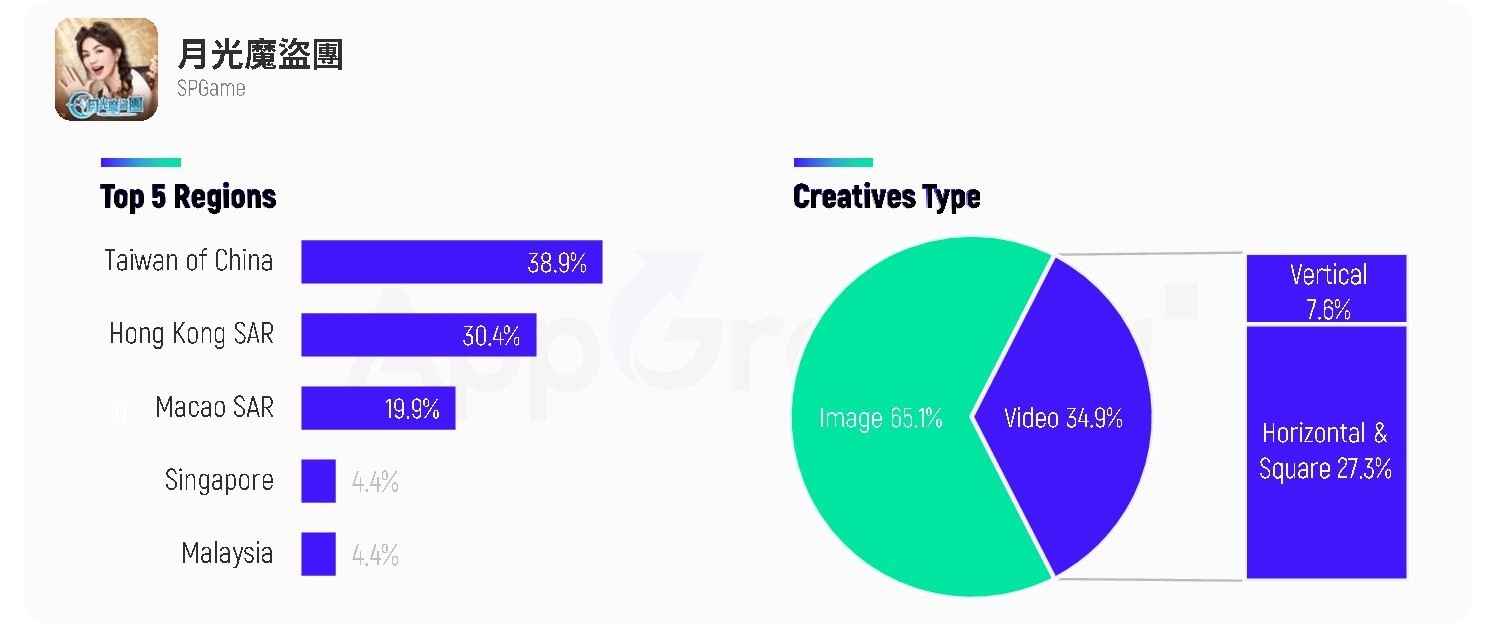

Its main advertising regions in August were the same as the target markets in pre-registration, which were Hong Kong, Macao and Taiwan of China, Singapore and Malaysia, with Taiwan of China accounting for the most proportion at 38.9%. The ad creative formats were mostly images, while videos were mainly horizontal and square.

Overall, the tactics of user acquisition for midcore and hardcore mobile games in Hong Kong, Macao and Taiwan of China have been relatively fixed. Usually, publishers pick local celebrities as spokespersons during the one-month or so pre-registration and large-scale advertising campaigns. At the same time, content for brand marketing (e.g. game theme songs, music videos) is carried out in combination with the spokespersons' characteristics.

Moonlight Pirates is a multi-layered attempt. SPGame invited ELLA, a famous singer from Taiwan of China, to be the spokesperson, and invited Japanese singer 天月 - あまつき - to perform the theme song Shimmer. Also, it produced a promotional song based on a hit TikTok song, which is a combination with the trendy short video culture.

In terms of creative content, the ads for Moonlight Pirates in the pre-registration period are mainly in two directions: one is the game introduction + rewards appeal, and the other is the celebrity spokesperson's recommendation.

The former is mostly a simple list of benefits, but SPGame is more skillful in packaging. For example, the following video combines the pre-register campaign with the unboxing of high-value digital products and voice-over to impress players with the idea that "pre-registers are rewarded with great prizes" to attract downloads, which is much more effective in grabbing attention than a simple list.

Comparatively speaking, the creatives of the spokesperson recommendation type are moderate. For example, at the beginning, the endorser is revealed to grab attention, and then she reads the voice-over to explain the gameplay and highlights.

Case2: Isekai:Slow Life

Isekai: Slow Life, an otherworldly Mobile RPG by Mars-Games, combines the gameplay of manage. Its key selling point is the plot and characters, with a bright Japanese anime art style to create a "slow life in other worlds" vibe.

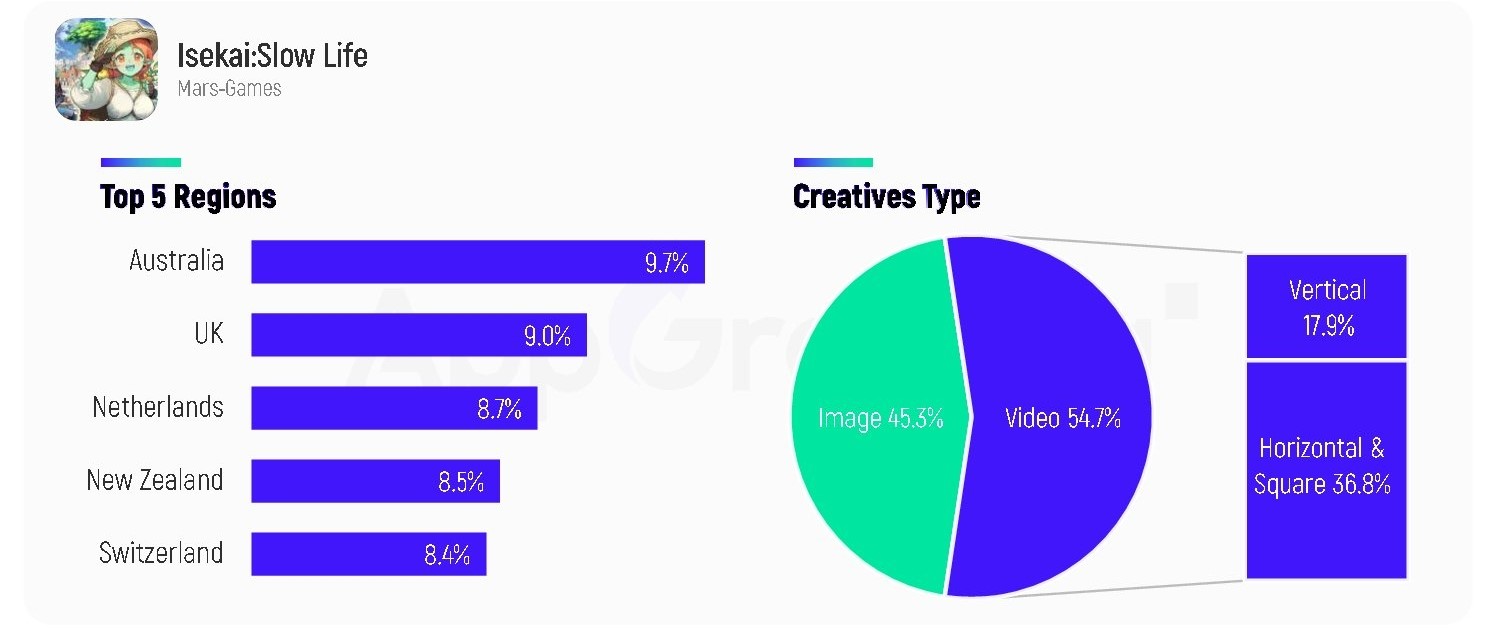

The game has now made a good start in the USA market and is gradually expanding to other regions. According to AppGrowing, its main advertising regions in August were Australia, the UK, the Netherlands, New Zealand, and Sweden. Creative types are heavily weighted toward video, with more horizontal and square.

On the creative side, Isekai: Slow Life's ideas are generally in two ways: one is the common character display, the other is the combination of the game theme with the idea of Manage games, which are popular in the European and American markets.

For instance, the video below applies the popular idea of choosing to rescue characters, commonly found in manage games. It indirectly done the localization by packaging the otherworldly theme into the form common to European and American players.

The following video shows manage gameplay, highlighting failure with character expressions to attract attention. Then, it presents the correct result in "rewind" and reinforces the game's charm with bouncing coins and numbers.